Why 2024 Might Be Your Year to Buy a Home (An Extended Analysis)

Why 2024 Might Be Your Year to Buy a Home (An Extended Analysis)

The dream of owning your own home often collides with the harsh reality of the housing market. Between ever-changing mortgage rates, fierce competition, and rising property costs, navigating the path to homeownership can feel like a daunting game of chance. However, for aspiring homeowners, 2024 might offer a unique window of opportunity. This extended analysis delves deeper into the local market, explores potential costs of waiting, and provides additional considerations for making an informed decision.

A Shifting Landscape: From Bidding Wars to Buyer Leverage

Last year’s local DFW real estate market, like much of the nation, was characterized by a seller's paradise. Bidding wars were commonplace, and homes flew off the shelves at record prices. However, the tide is starting to turn. Rising mortgage rates in 2023 dampened buyer enthusiasm, leading to a decrease in competition for available properties. This shift in dynamics presents a welcome change for serious buyers.

Ellis County Data: Unveiling the Numbers and Local Insights

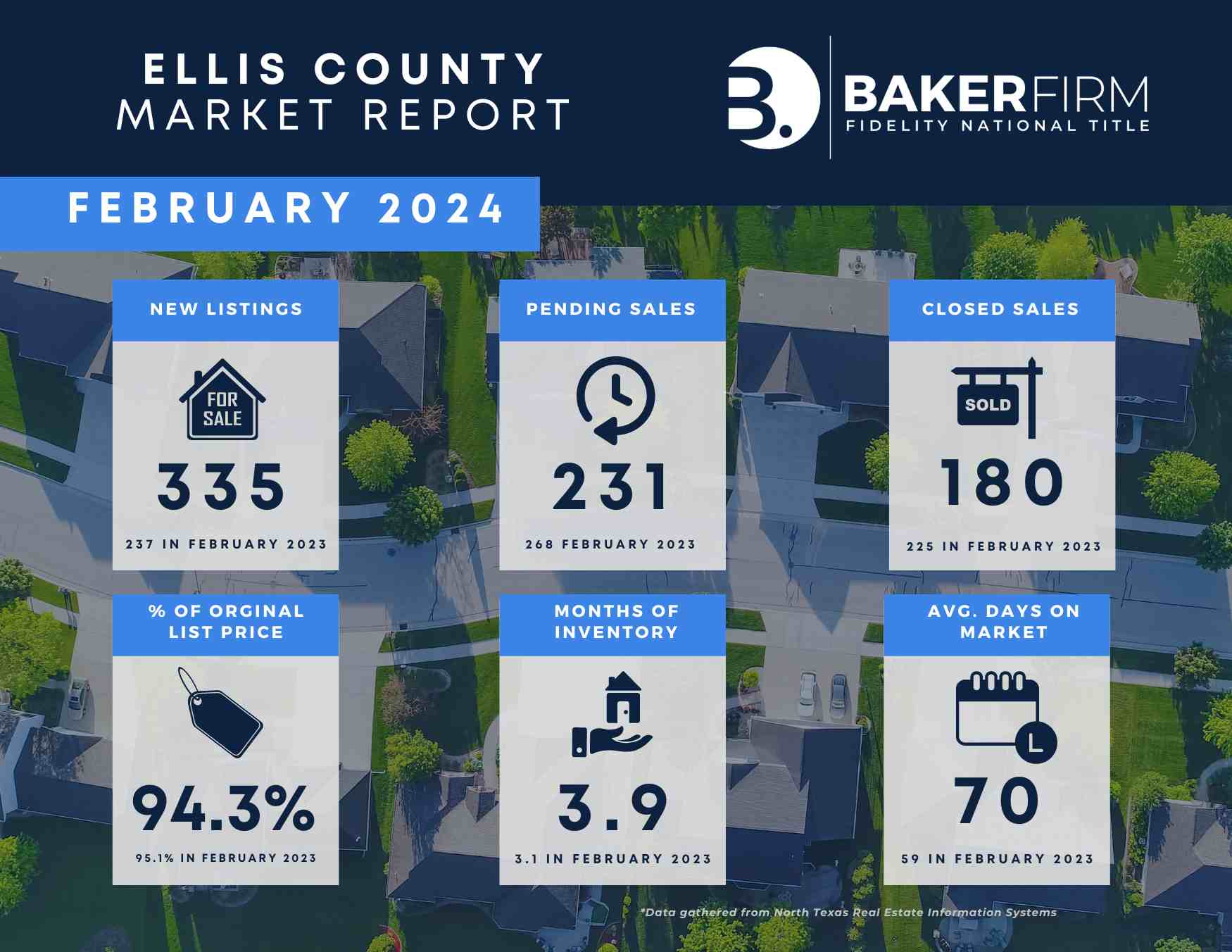

While national trends offer a starting point, understanding your local market is crucial. Let's delve into some key data points and explore local insights using Ellis County, Texas:

- Median Sales Price: According to Redfin, as of February 2024, the median sales price in Ellis County sits at $400,000, showcasing a 5.34% increase compared to the previous year. However, it's important to note that specific neighborhoods and property types can vary significantly in price. Consulting with a local realtor can provide crucial insights into micro-markets within Ellis County, ensuring you have the most accurate information for your specific needs.

- Inventory: The months of inventory, a measure of market balance, currently sits at 3.9 months in Ellis County.

- This indicates a shift towards a buyer's market compared to the previous year's tighter market with 3.1 months of inventory. However, local insights suggest that inventory levels can fluctuate depending on the seasonality of the market. Consider working with a realtor who can track inventory trends and advise on the optimal time to buy based on your preferences and budget.

- Sale-to-List Ratio: Realtor.com reports a current sale-to-list ratio of 97.18% in Ellis County. This signifies that sellers are generally getting close to their asking price, but also suggests some room for negotiation for savvy buyers. Local realtors can provide guidance on effective negotiation strategies specific to the current Ellis County market conditions, potentially helping you secure your dream home at a competitive price.

The Cost of Waiting: Weighing the Pros and Cons of Holding Out

While the prospect of lower interest rates might seem enticing, it's crucial to consider the opportunity cost of waiting. Here's a breakdown of some factors to weigh, incorporating additional considerations specific to your local market:

- Potential Market Appreciation: Though not guaranteed, home prices in the DFW Metroplex have historically seen steady appreciation. While the rate of increase might slow down in the near future, waiting for a significant drop in prices could be risky, especially considering the potential for continued property value growth. Additionally, local factors such as infrastructure development or the establishment of new businesses in your market (think about all the road construction and building development around you!) could lead to unexpected surges in property values, further amplifying the potential costs of delaying your purchase.

- Rising Rent Costs: Renting in Ellis County has also seen upward trends. According to Rentometer, the average rent for a 4-bedroom house in Waxahachie, TX is currently $2,679. By continuing to rent, you're essentially paying someone else's mortgage while missing out on building your own equity. Furthermore, rents are projected to continue rising due to factors like increased demand and limited new construction. Locking in a mortgage payment could offer greater financial stability compared to the potential fluctuations of the rental market.

- The Emotional Factor: Owning a home offers a sense of stability and security that renting simply cannot replicate. The ability to personalize your space, build a foundation for your future, and contribute to the growth of your community can be priceless, even if the initial costs seem slightly higher than anticipated. Additionally, owning a home allows you to participate in the local housing market and potentially benefit from long-term appreciation, contributing to your overall financial well-being.

Ellis County Specific Example:

Let's consider a hypothetical scenario to illustrate the potential cost of waiting. Imagine you're interested in a $400,0,000 home in Ellis County with a current mortgage rate of 6.5%. If you decide to wait for the rate to drop to 6%, which might take several months, here's what you might miss out on:

- Increased Purchase Price: Even a modest 3% price appreciation in the next year could translate to a $12,000 increase in the home's cost. This price hike, coupled with rising rent, could significantly impact your overall affordability compared to locking in a purchase price today.

- Lost Equity: By continuing to rent for a year, you could be missing out on building equity of approximately $24,000 (based on a 6% down payment on the $400,000 home). Additionally, you would forgo the potential tax benefits associated with homeownership, such as the mortgage interest deduction and property tax deduction.

- Opportunity Cost of Rent: With the average rent for a 3-bedroom house at $2,500 per month, waiting for a year would mean spending $30,000 on rent without any equity benefits.

Making an Informed Decision: Beyond the Numbers and Local Considerations

While data, financial considerations, and local insights are crucial, the decision to buy a home is ultimately a personal one. Here are some additional factors to consider, incorporating the specific context of Ellis County:

- Your personal financial situation: Are you prepared for the upfront costs of buying a home in Ellis County, including a down payment (which can vary depending on your loan type and qualifications), closing costs, and ongoing maintenance expenses? Consider consulting with a local mortgage lender to discuss your financial situation and determine which loan options are best suited for your needs.

- Your long-term plans: Do you plan to stay in the area for the next 5+ years? Owning a home becomes a more attractive option if you plan to live there for several years, allowing you to benefit from potential long-term appreciation and build equity in your property. Consider your future career goals, family plans, and overall desire to establish roots in the community.

- Your emotional readiness: Are you emotionally prepared for the responsibilities and commitment that come with homeownership? Owning a home requires regular maintenance, potential repairs, and ongoing financial obligations. It's essential to assess your readiness to take on these responsibilities and the potential challenges that might arise.

Seek Expert Guidance: Navigating your Local Market with Confidence

Surrounding yourself with experienced professionals familiar with your particular market is vital for making an informed decision. Here's how seeking expert guidance can benefit you:

- Local Real Estate Agent: A trustworthy real estate agent with expertise can provide invaluable guidance on finding the right property, navigating the buying process, and negotiating effectively with sellers. They can also offer insights on specific neighborhoods, school districts, and potential future developments that might impact your investment.

- Mortgage Lender: A qualified mortgage lender can assess your financial situation and recommend the best loan options based on your individual circumstances and desired loan terms. They can also help you understand the various mortgage products available, including down payment assistance programs that might be applicable.

By combining thorough research, personal reflection, and expert guidance, you can confidently navigate the housing market and make an informed decision about whether buying a home in 2024 is the right step for you. Remember, owning a home is a significant investment, and a well-informed and well-prepared approach can help you unlock the door to your dream home and build a solid foundation for your future.

Categories

Recent Posts